Have you ever wondered why we as a society just don't travel everywhere on foot instead of using vehicles?

Of course you haven't, what kind of thought is that?

Most people don't like to intentionally make everyday life hard on themselves. In fact, if you're reading a personal finance blog you're probably looking to make things a bit easier.

So how can we make growing our wealth easier?

Well, over time I've realized that I can save myself thousands of dollars per year by adopting a more efficient lifestyle.

What constitutes an "efficient lifestyle" you may ask?

In my opinion, an efficient lifestyle is one in which you're actively working to eliminate things that don't return a good value for your time and effort. It's about constantly reflecting on your weekly habits and working to cut out waste and redundancy that may be costing you money.

I realize it sounds like a lot of effort, but here are 5 simple strategies you can start using right now that will help increase your efficiency and leave you with more money in your wallet at the end of the month than before.

1. Review Your Spending at the End of Every Month

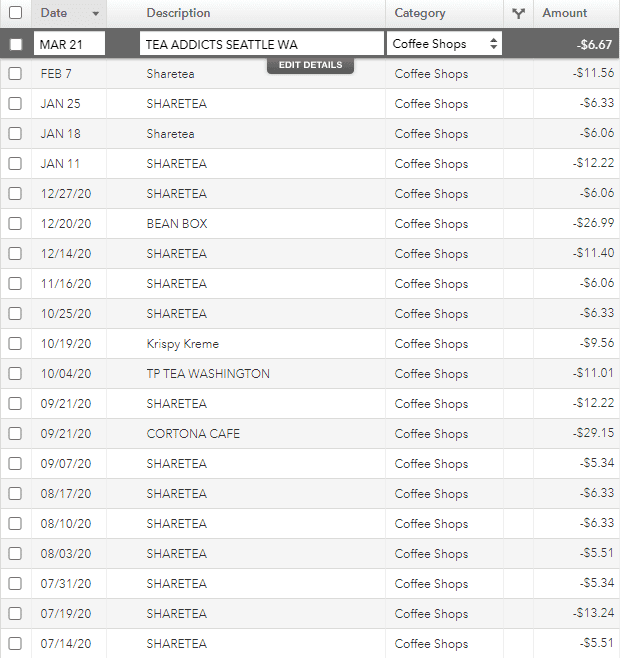

The easiest place to start is your bank account. You have a complete history of all your transactions, both big and small at your fingertips. Take time to review how you've been spending your money for the past month and figure out where you can make changes.

What You Need to Do

- At the end of each month find time to go through all of your transactions.

- For each transaction, reflect on how much value you got out of the purchase.

- Sort each item into a category (Food, Entertainment, Pet Supplies, etc).

- Look over every category of spending and decide if you're overpaying in any aspect of your monthly expenses.

Pro Tip! You can track all of your spending in one place using your budgeting app of choice (I use Mint)

Why It Works

Looking over your transactions should help you reflect on how much you've spent on things you didn't really want or need.

For example, I don't know how many times I used to go through my purchases to see free trials I accidentally let renew, grocery bills that crept up over the month, or random Amazon orders I forgot I made.

Understanding where the most wasteful or expensive purchases come from helps me understand what parts of my budget I need to pay more attention to.

2. Plan Out Your Meals for the Week

I remember always begging my mom to go to McDonald's on the way home from school. Nine times out of ten her answer was always the same, "We have food at home."

Well, roughly two decades later I can look back and say that I can see where she's coming from.

What You Need to Do

- Get serious about planning out all of your meals for the upcoming week: breakfast, lunch, dinner, and even snacks.

- Take into account the food you had to throw out the previous week, and try to make corrections to reduce the likelihood of the same thing happening in the upcoming week.

- Avoid buying excess groceries by only getting enough to satisfy your planned meals.

Important! Make sure to factor in your fast-food adventures and weekend brunches!

Why it Works

Precision goes hand in hand with efficiency.

It's the same reason you look at the directions on the back of the pancake box for the serving sizes instead of making the whole thing and throwing out whatever you don't eat.

I was the worst at this. I would always buy food based on a recipe's ingredients list and end up having enough food to feed a family for a week. Coupled with occasionally eating out on the weekends, I would always end up throwing out a quarter to half of the food I bought. And I wasn't the only one making this mistake. The average American family of four throws out $1,500 in food per year. That's $375 per person.

Once I started adjusting the amount of food I bought to match my eating habits I was able to cut my grocery bill by roughly 40%.

Understanding your meal patterns takes a small fraction of your time, and in return, you'll reduce your waste and end up spending less to eat the same amount.

Remember! There's nothing wrong with eating out every once in a while but don't do it at the cost of throwing out a decent chunk of your food at home.

3. Always Prepare a List Before Grocery Shopping

How often do you go into the store for three items and leave with ten?

That's because you've activated the store's trap card.

From the minute you walk in up to the minute you're ready to leave, grocery stores are trying to sell you stuff. The process is designed to be inefficient. The longer you spend walking around figuring out what you want, the more likely you are to buy that Digiorno's Pan Pizza calling to you from the frozen dinner aisle.

So what do you do when the place you buy your food from is using Jedi mind tricks to convince you to waste money?

You make a list.

What You Need to Do

- Find your recipe(s) for the week, figure out what ingredients you need.

- Factor in some snacks and whatever home supplies you need to restock on.

- As soon as you enter the store, put your blinders on and stay committed to your list.

Why it Works

Going grocery shopping without a list leads to improvisation.

You'll find yourself buying duplicates of ingredients you already have, throwing random items in your cart as you're wandering the aisles, and sometimes having to make a second trip to the store because you forgot something.

A well-put-together list solves all of that.

I find that a simple grocery list not only saves me time and money but also gives me a more realistic week-to-week picture of what my real, uninfluenced grocery budget looks like.

4. Wait One Day Before Big purchases

This is a simple strategy that can go a long way.

A lot of big purchases (especially cars) depreciate immediately, so give yourself time to think on decisions that can make a dent in your wallet.

Studies have shown that shopping triggers the same reaction in your brain as getting high. Shopping can be addicting and exciting, and it can lead us to make unnecessary purchases just because we're caught up in emotions.

Taking 24 hours to think about big purchases will affirm to yourself that what you're looking to buy will actually provide you value as opposed to being a mostly emotion-driven decision.

5. Budget Every Dollar

A solid budget is truly the key to a more efficient lifestyle in regards to your finances.

The only way to know if the strategies I discussed above are working is to understand where all your money is going.

What You Need to Do

- Take time to budget every dollar. Allocate money for food, travel, entertainment, savings, investments, and even miscellaneous purchases.

- Look for patterns in your spending and challenge yourself to cut down on exceptions in those patterns.

- Stabilize and reduce monthly spending for important aspects of your life, and as those things begin to cost you less, increase the overall money you put into savings.

Why it Works

You can't practice efficient living until you are able to differentiate the valuable decisions from the wasteful ones.

Learning to budget is almost the personal finance version of "seeing the Matrix".

You will immediately begin to see how much you could potentially save by planning out your spending as opposed to shooting from the hip and assessing the damages afterward.

A Word of Warning: Sacrifices May Need to be Made

Keep in mind that if you want to begin working towards a more efficient lifestyle, you'll likely need to make sacrifices.

Cutting out waste means actively keeping your impulses in check and frequently questioning the financial decisions you're making, which can be a bit of a bummer sometimes.

Just know that with proper planning you can reclaim that spontaneity and freedom on your own terms, while also growing your wealth and working towards financial independence at the same time.

Give it a Shot!

I truly believe that an efficient lifestyle goes hand in hand with building strong personal finance habits.

These strategies have helped me cut down on my monthly waste and spending, and now it's your turn to give them a shot.

Do you have any helpful strategies of your own? Reach out and let me know!